We are looking to disburse loan worth Rs 1,000 crore by March 2020: Sanjay Chaturvedi, CEO, Shubham Housing

NEW DELHI: Shubham Housing Development Finance is looking at a loan disbursal of Rs 1,000 crore by March 2020, according to Sanjay Chaturvedi, CEO of the company. The company expects a compounded annual growth rate (CAGR) of 35-40 per cent in this financial year.

Shubham Housing was formed in 2011 and has an office presence in more than 84 cities across 12 states and has a team strength of around 1400+ employees. The company had raised series D investment of Rs 305 crore from investors like Premji Invest and Helion Venture Partners & Elevar Equity.

In conversation with ETRealty, Chaturvedi talked about his company's growth plan.

What was your loan disbursal in 2018 and what kind of growth did you witness?

In 2018, the company disbursed loan worth about Rs 600 crore. In last eight years, we have disbursed more than Rs 2,300 crore to customers towards the purchase of affordable housing units.

We witnessed a growth of 26 per cent in FY19 while the industry has seen a growth of 18-20 per cent in the last one year.

In 2018, our return on assets was 1.5 per cent. We want to reach 2% this year.

What was your loan book size in 2018?

Currently, our loan book size is Rs 1,300 crore which we plan to take to Rs 4,000-5,000 crore in the next 2-3 years.

What is the segment you operate in?

We operate in the affordable housing segment with loan size varying from Rs 3-50 lakh. Our average ticket size is Rs 8 lakh with interest varying from 12-22%.

Was there any impact on Shubham of the overall volatility in the housing finance industry?

We witnessed a slight impact probably of 50 basis points in the cost of funds. But since we do not have exposure to high-end segment, the impact on us was minimal."

What is your operational expenditure?

Shubham operational expenditure to AUM is about 6-6.5 per cent while the average industry operational expenditure to AUM is about 2-2.5 per cent. The operational cost is high in comparison to industry standards majorly because of the segment we operate in requires manual checks which is an operational cost. We hope to bring it down but it still be somewhat higher than the industry standards.

Are you looking to expand/consolidate in 2019?

The company currently has 90 branches. There may be some consolidation and we may close some branches this year.

What is your non-performing assets (NPAs) position?

In 2018, our NPAs were about 2-2.5 per cent while the average industry NPA in 2018 was about 1-1.5 per cent.

Where does majority of your demand comes from?

About 50 per cent of the loans are being disbursed in tier-II cities, 35-40% is being disbursed in tier-I cities while the rest is disbursed in smaller cities. For us, majority of the demand is coming from those looking to build individual houses.

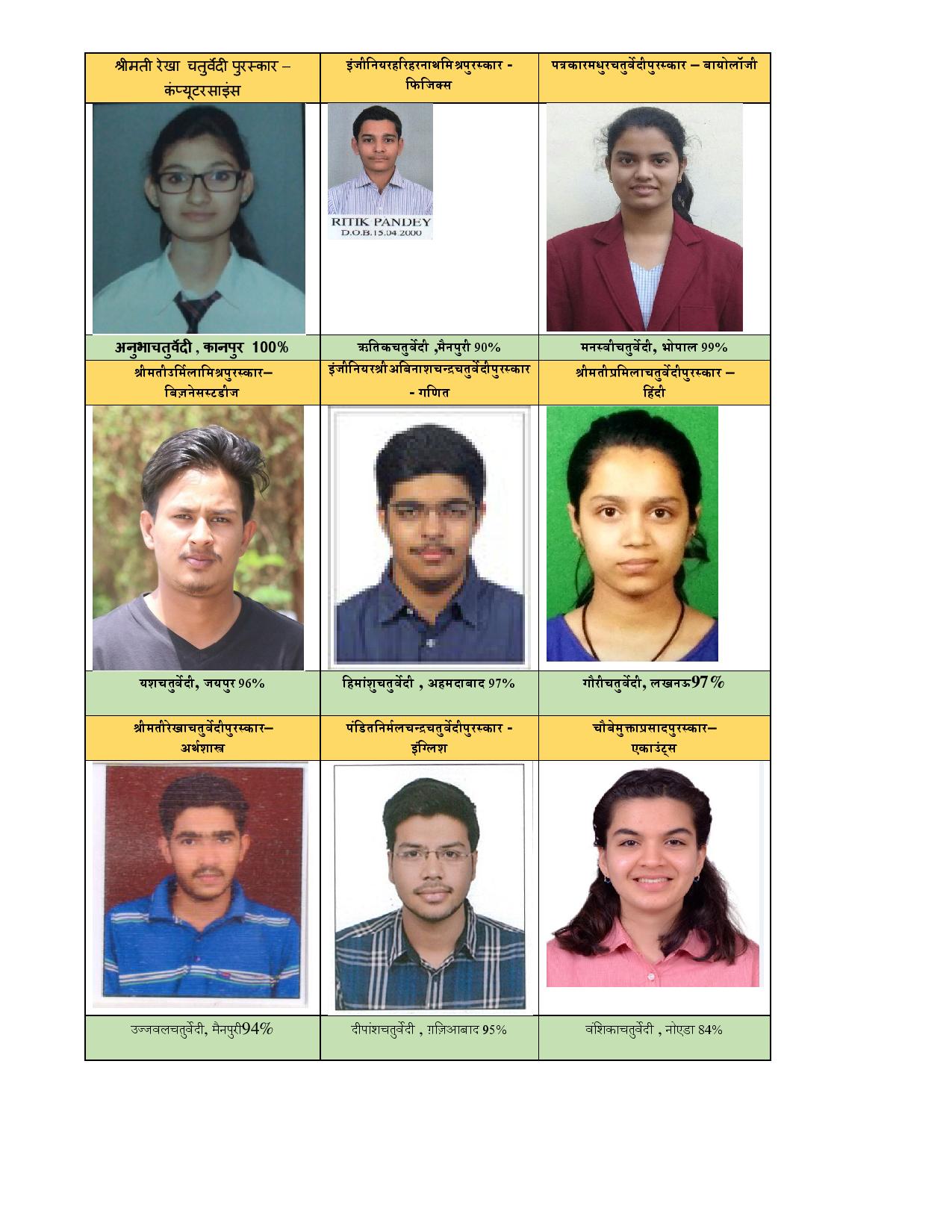

.jpeg)

Feed from WhatsApp